A Mission to Increase our customer’s financial health, from savings to Investing.

Digital Guidance and Advice (DGA) is a native iOS and Android app intended to Bring Insightful, Proactive and Holistic advice to the customer, where ever they may be in their financial journey.

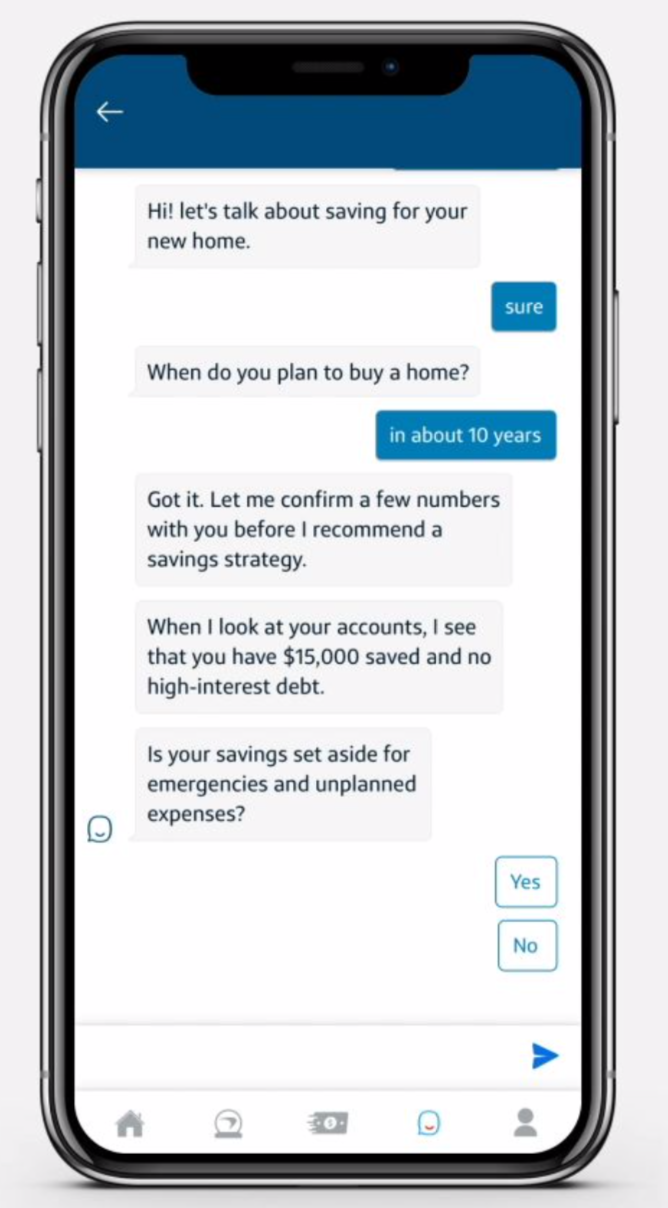

It incorporated a natural language chat interface (CUI), engaging page elements, data visualizations, and flexible widgets that offered entry points through the capital one app experience.

Our Focus: Design a experience that makes it easy for the user to track, monitor and edit their custom financial goals, while elevating key financial insights at the right time.

My Role

Defined and evolved the team’s approach to design innovation.

Facilitated rituals with our multidisciplinary UX team to define a customer journey.

Identified focus areas for innovation based on the prioritized customer problems, data from user research, competitive analysis, and our legacy Capital One products.

Translated concepts into an end-to-end experience.

Defined a visual framework for content that aligned to our design principles.

Worked with product, tech, research, and regulatory partners to determine the scope of the experience, and providing ongoing build support for all DGA launches.

Socialized and promoted our experience with VP+ level executives at Capital One.

Created, defined, and socialized new components and patterns to Capital One design partners.

Customer Problem

Customer’s are overwhelmed with financial anxiety, and struggle to prioritize their financial health amongst other monetary goals and purchases. They are seeking to find holistic financial guidance that meets them where they are at today, and helps them accomplish the goals they have top of mind.

A mission to increase our customer’s financial well-being, from saving to investing.

Business Problem

By providing a graduation path from savings, debt reduction to investing, we increase the retention of our current customers and provide them ways to build their wealth. Bank customers with investing accounts have 45% lower attrition than those without. DG+A graduation to investing is a path for Capital One to grow with our customers.

DG+A Launch ROADMAP

Our 2018 - 2019 DG+A Launch and Release Roadmap

Debt, Savings and LauNches

Initially, our teams were organized into multidisciplinary groups that we called UXGs. I was the lead on the Debt Reduction team that we called, “DRUX”. As part of the first quarter of 2018, our team developed a high-confidence debt reduction concept, we realized something that would become critical to the foundation of the DG+A experience.

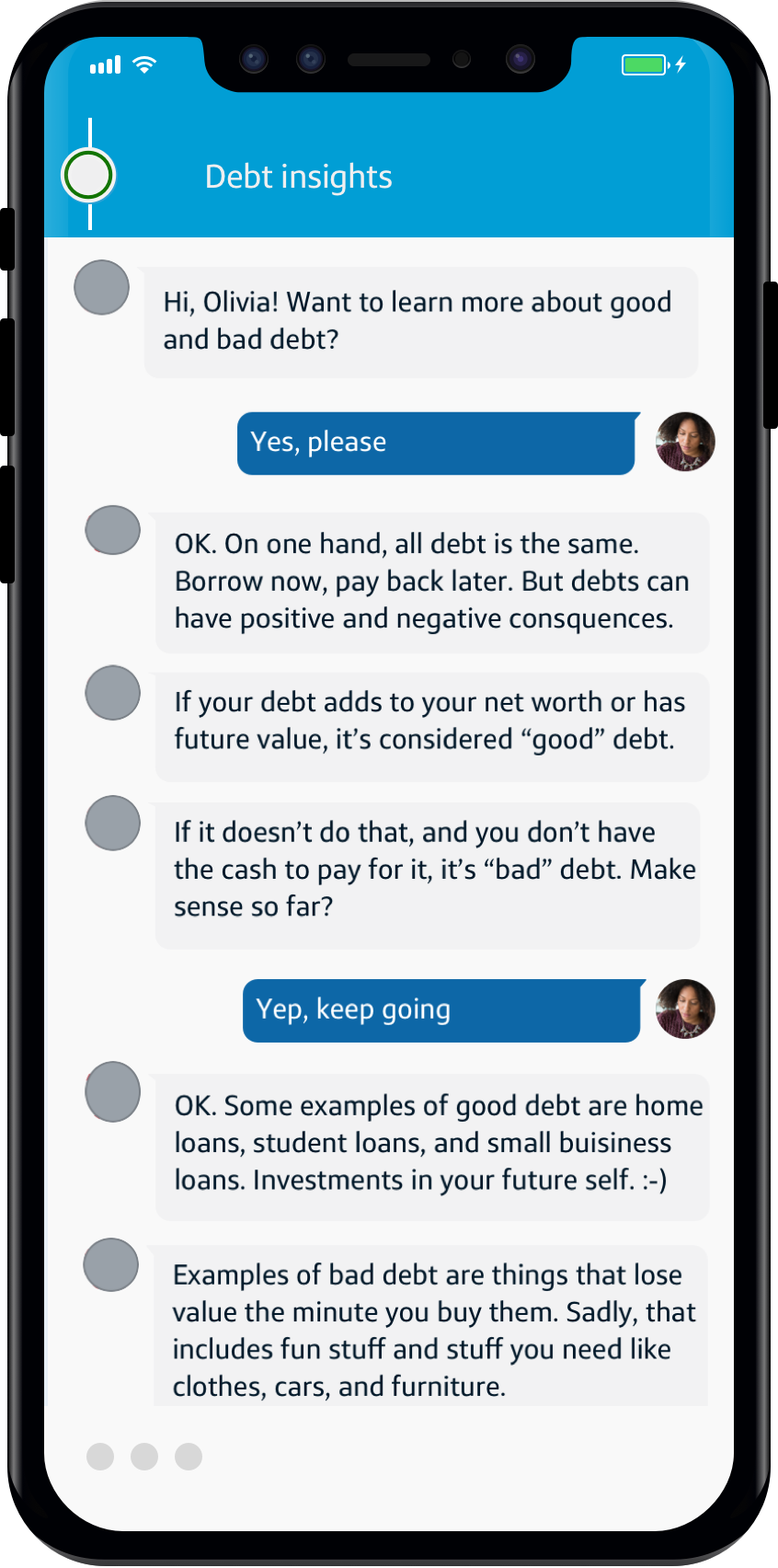

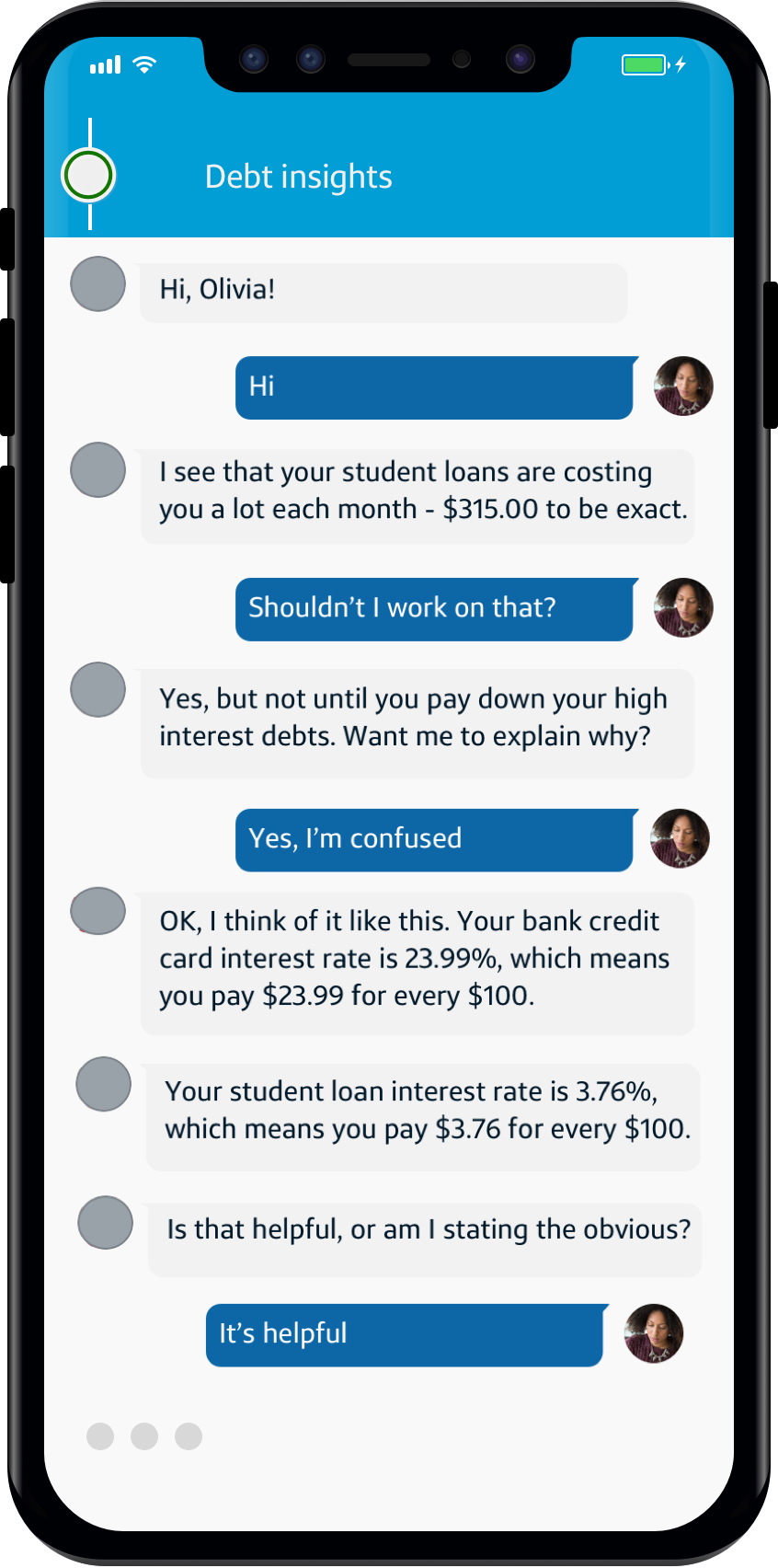

DRUX tested a hybrid chat UI and Page UI experience that provided guidance and context to built trust with users while allowing them to “go deep” into their data when needed. User research participants reacted enthusiastically to seeing our guidance in the context of their data and full financial picture. Due to the success of this approach, I was asked to lead the design of the first DG+A launch.

As we worked together to determine the prioritized features to be released with Launch 1, I advocated that we provide both a savings and debt experience for our customers. While our product team was in favor of focusing only on savings for our first release, it was clear from our research that without a debt reduction experience, we would not fulfill the promise of holistic financial guidance. In addition, during research we heard that users often felt that they couldn’t begin to save without managing their debt as well.

Launch

Monthly Overview

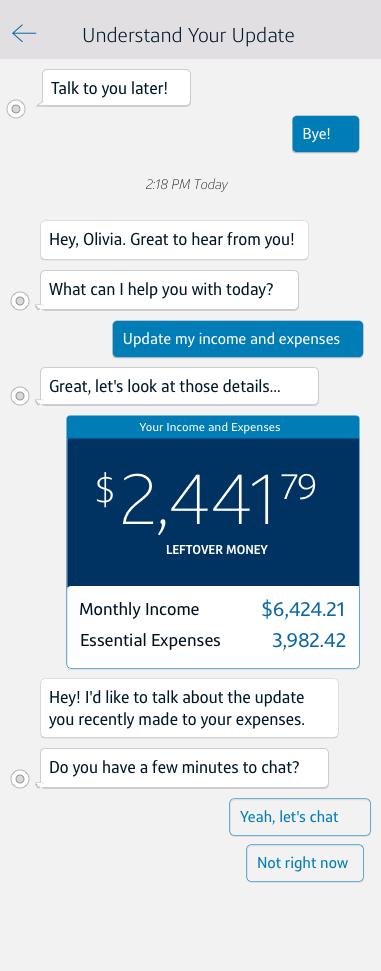

Due to the positive signal from Debt Overview, we have developed a key design principle that supported the DGA holistic vision; “Let me know you’ll be there for my whole financial journey”. Our research gathered that user’s did not expect DGA to be flexible and adapt to changes in their financial data. This user signal informed our team that Olivia wants to know that the advisor will work hard to keep her on course for good decisions and help her realize how those decisions impact to her whole financial journey.

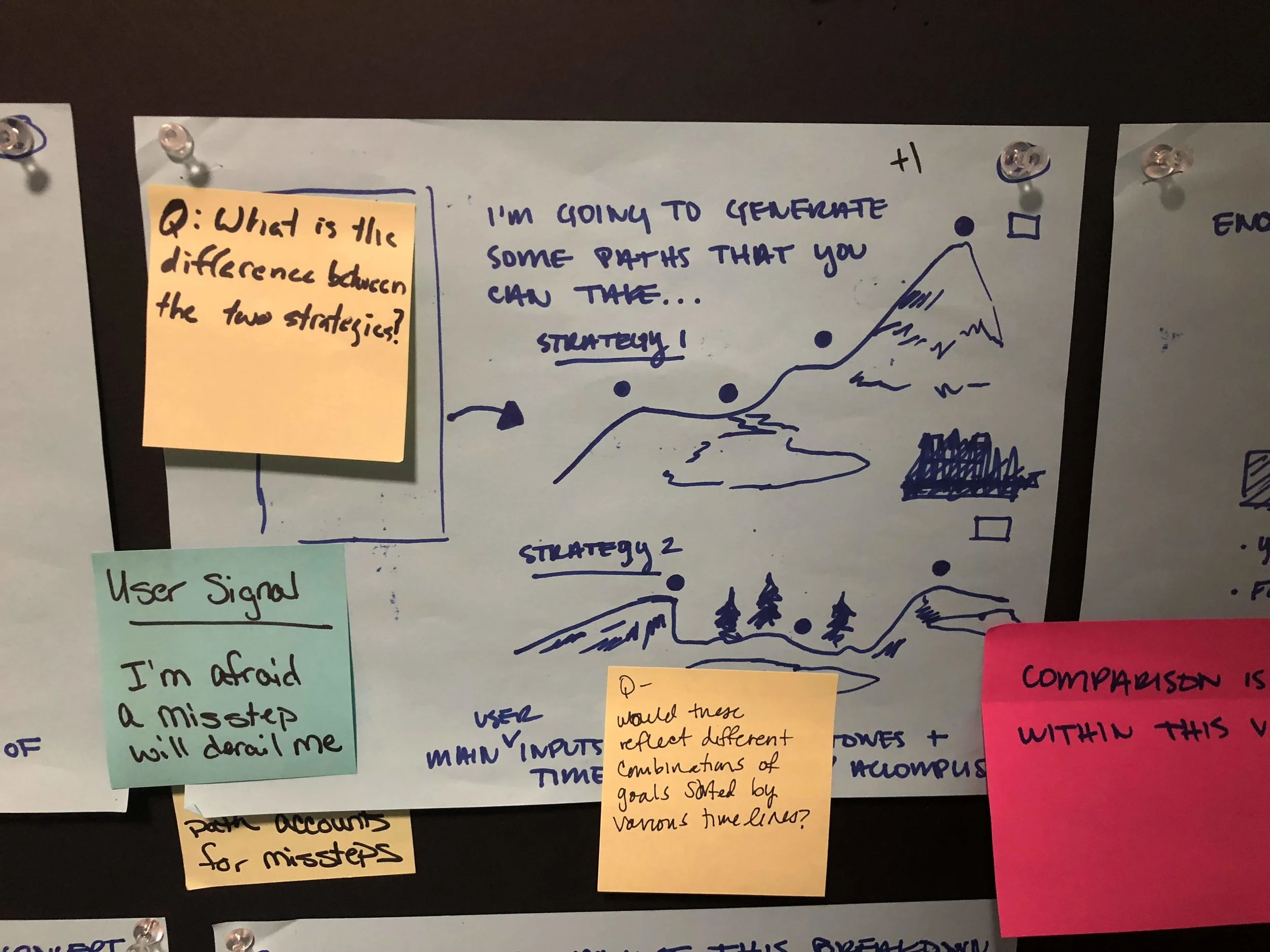

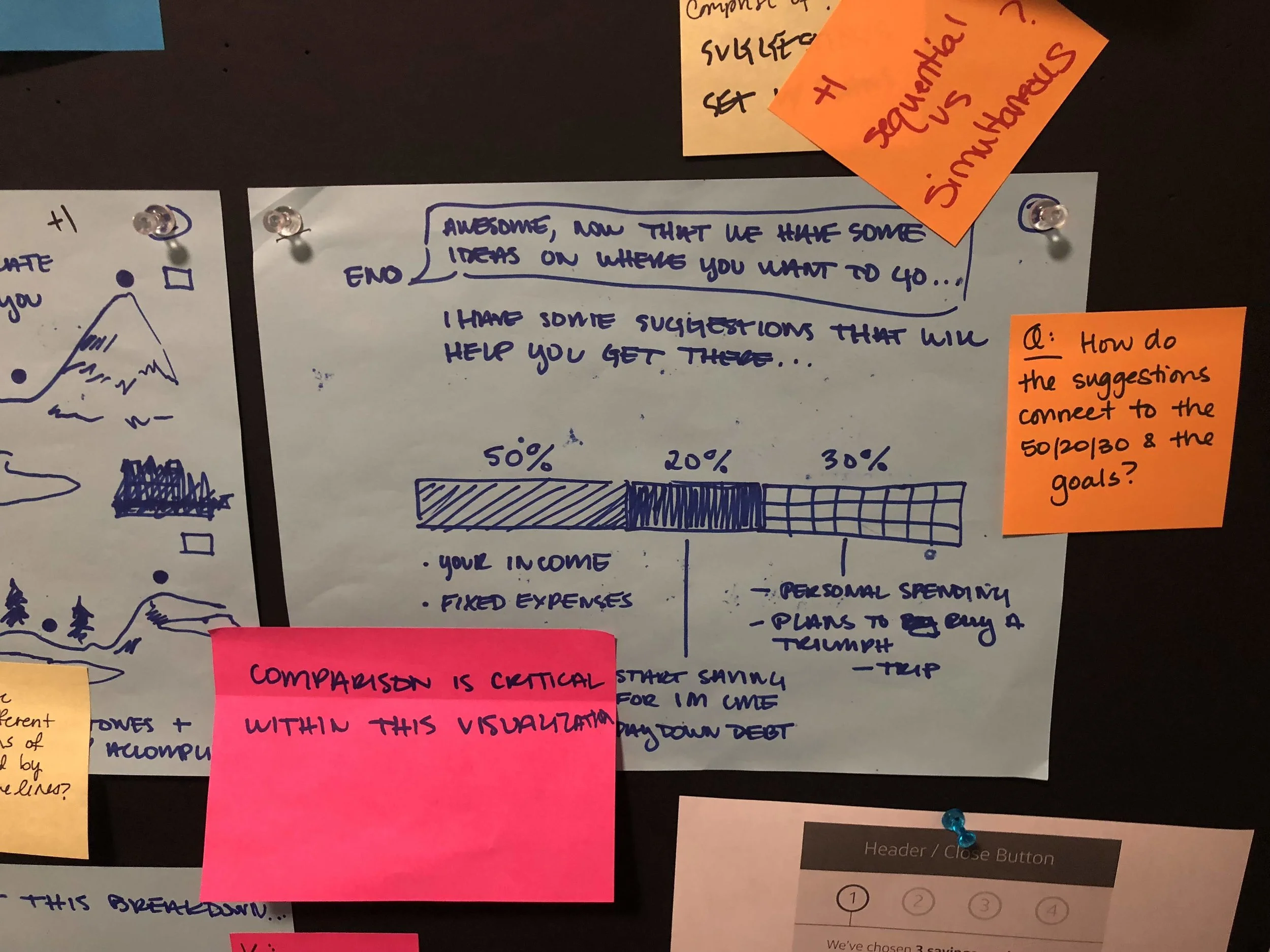

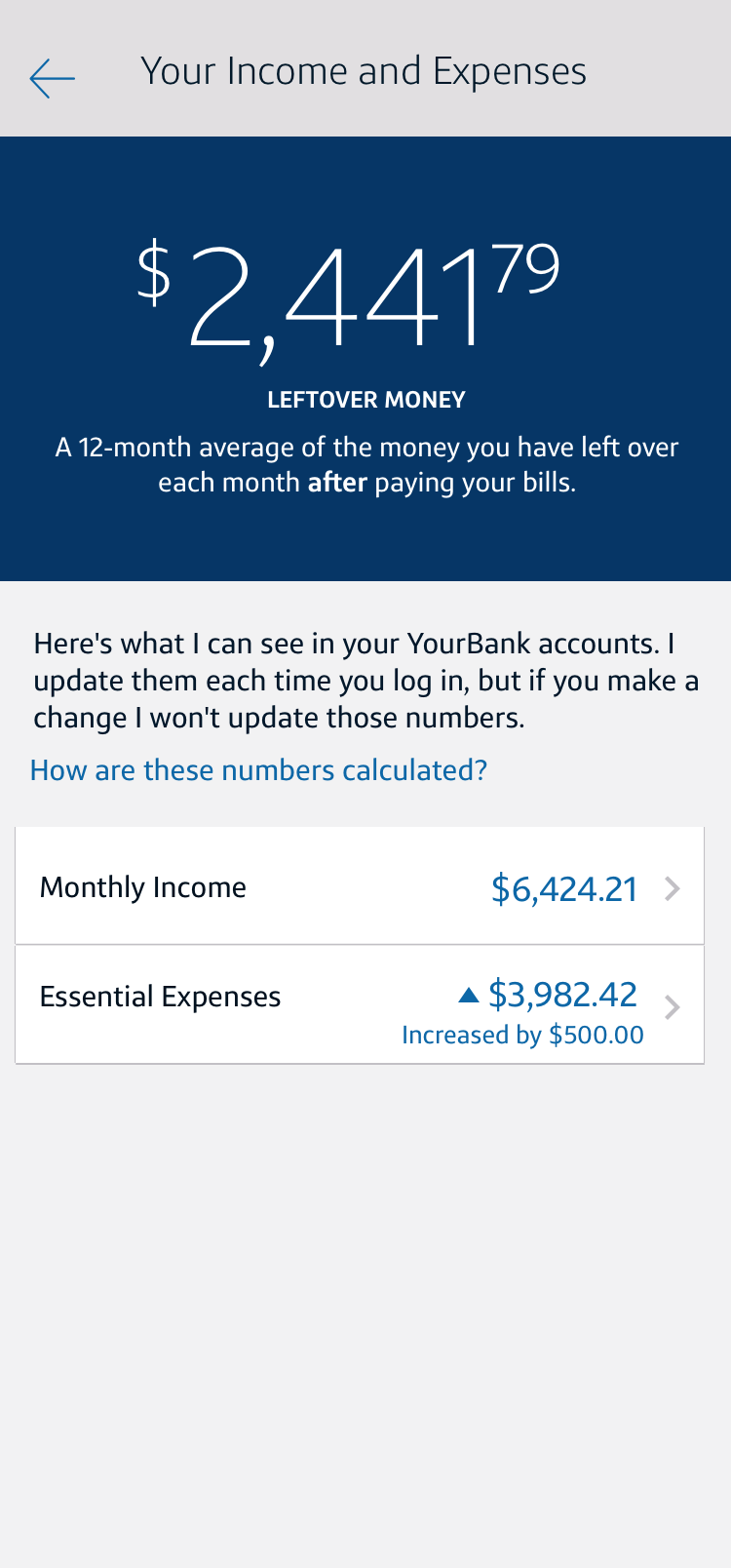

In order to help provide that adaptive experience, we needed to gather data that would inform our guidance, and provide easy ingress points for augmentation. I led an innovation effort on something we called “Overview” which would have provided an easy way for users to view their full financial picture.

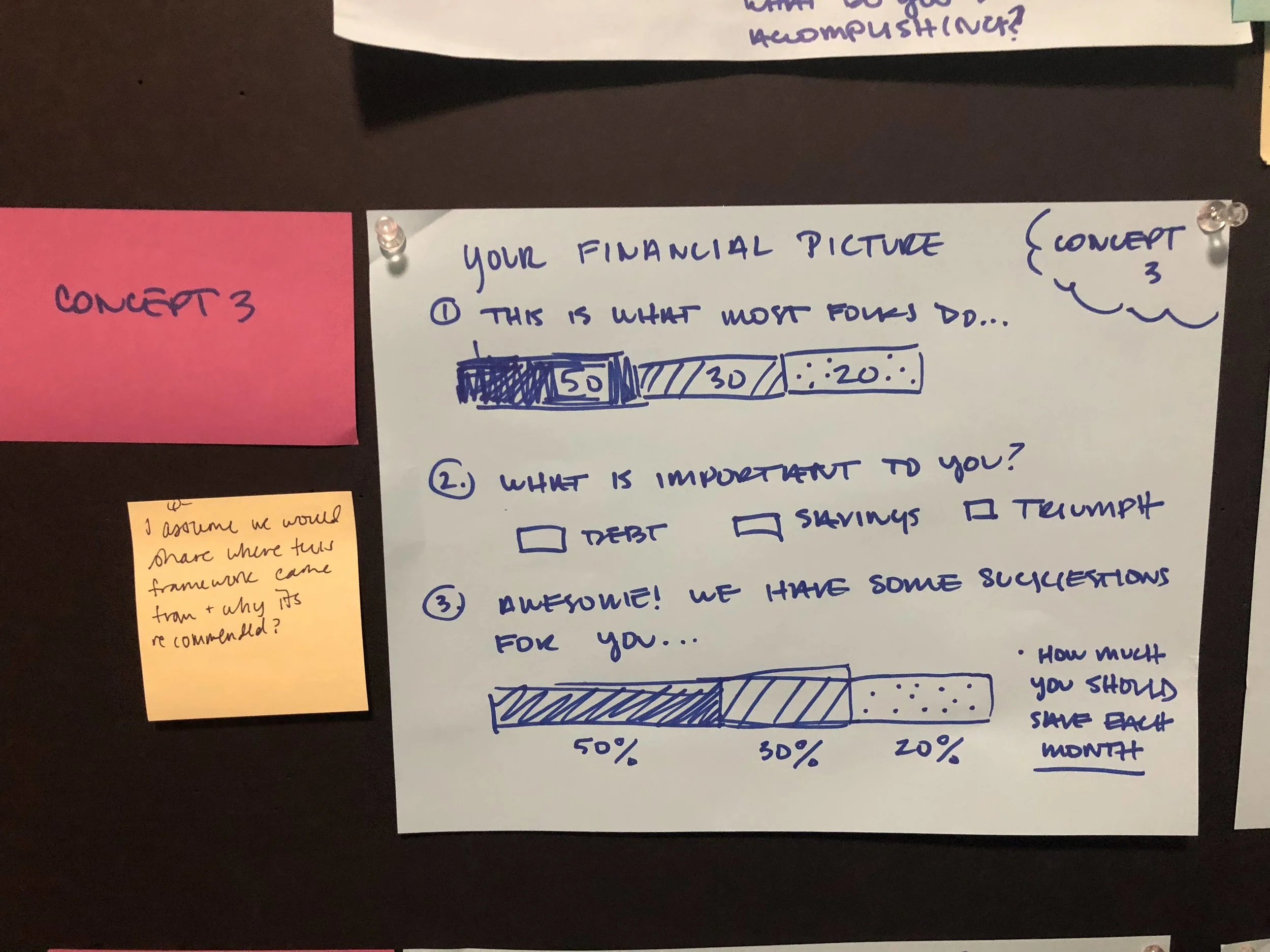

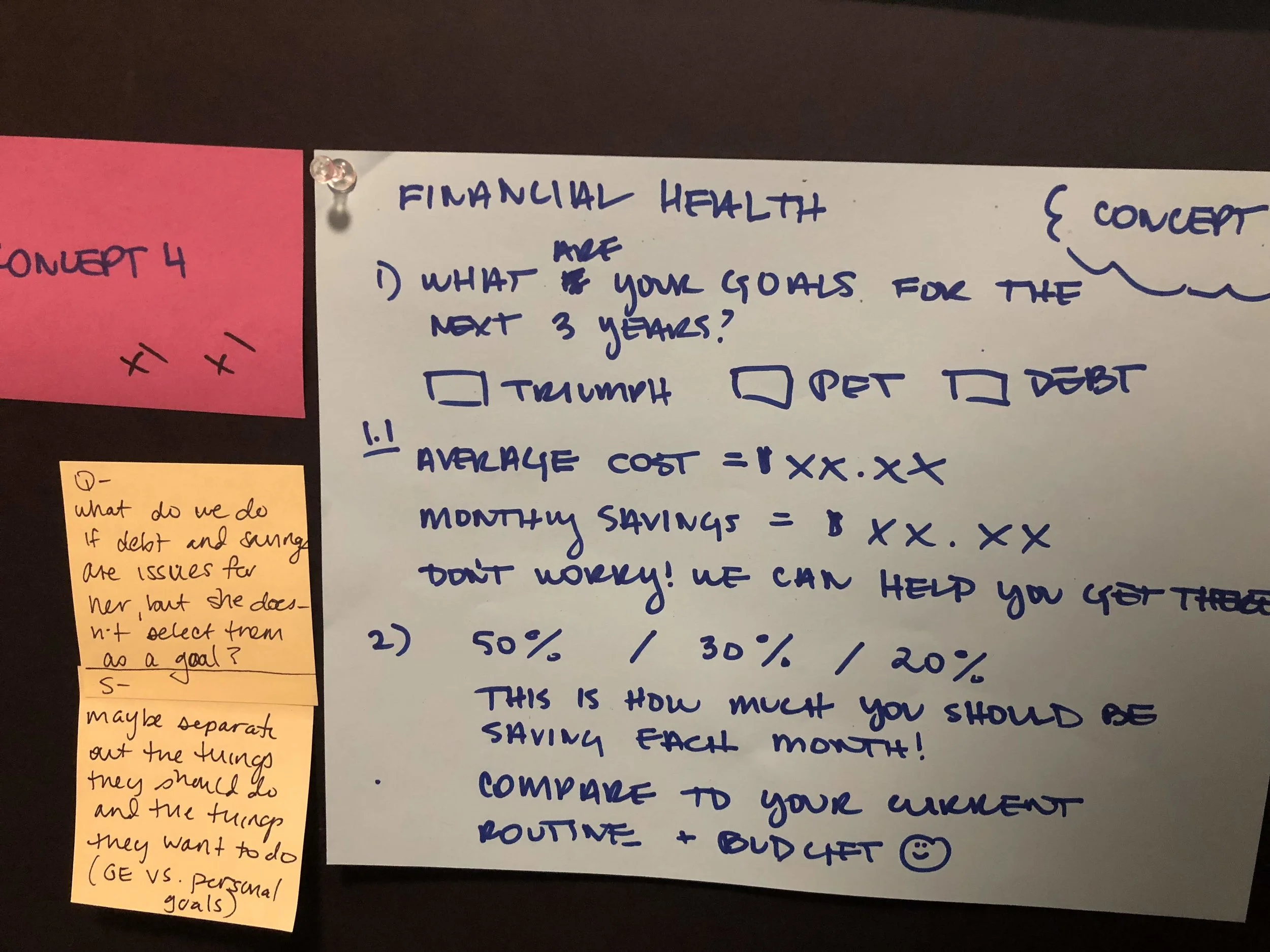

Brainstorm on 50/30/20 Rule

Final Monthly Overview Solution

Post Beta

Deepening Relationships

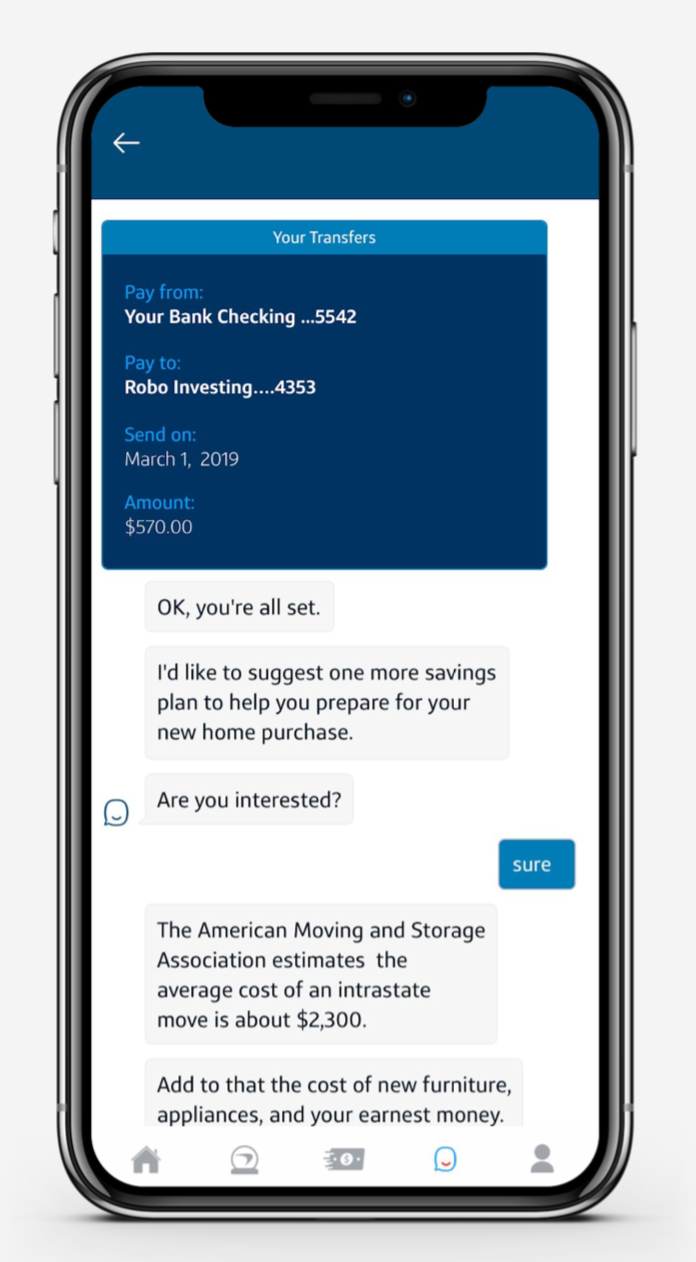

Knowledgeable, approachable, and insightful conversations that guide Olivia make financially healthy decisions.

Through the support of a hybrid Natural Language Understanding service, we can interpret the user’s intent, remain flexible in the conversation and provide helpful “hints” that help guide Olivia.

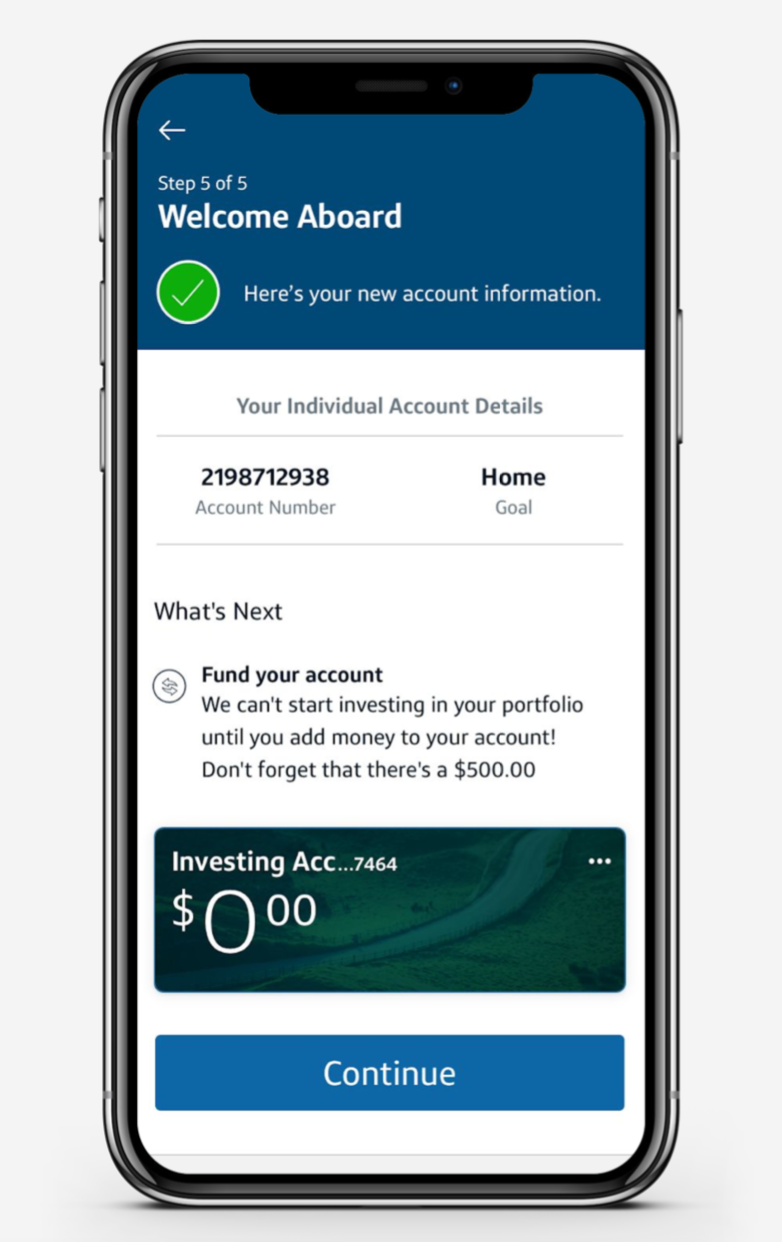

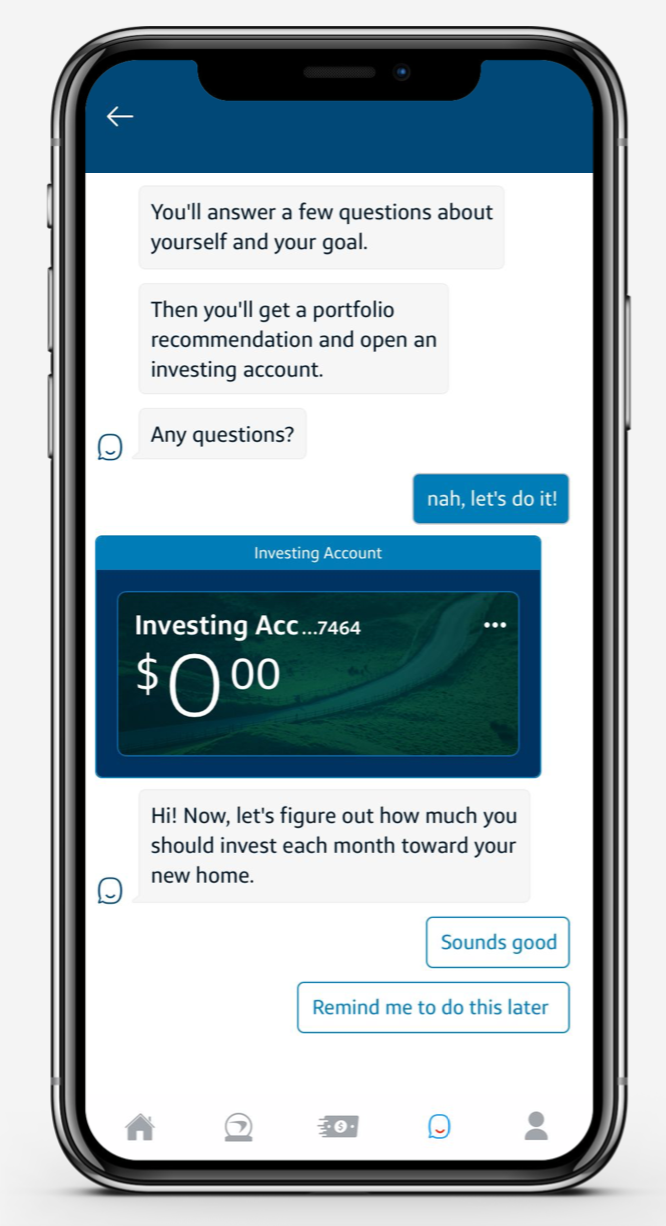

Cross Account Integration

By integrating across different Capital One products, we can provide continuity for the user as they Take steps towards financial health.

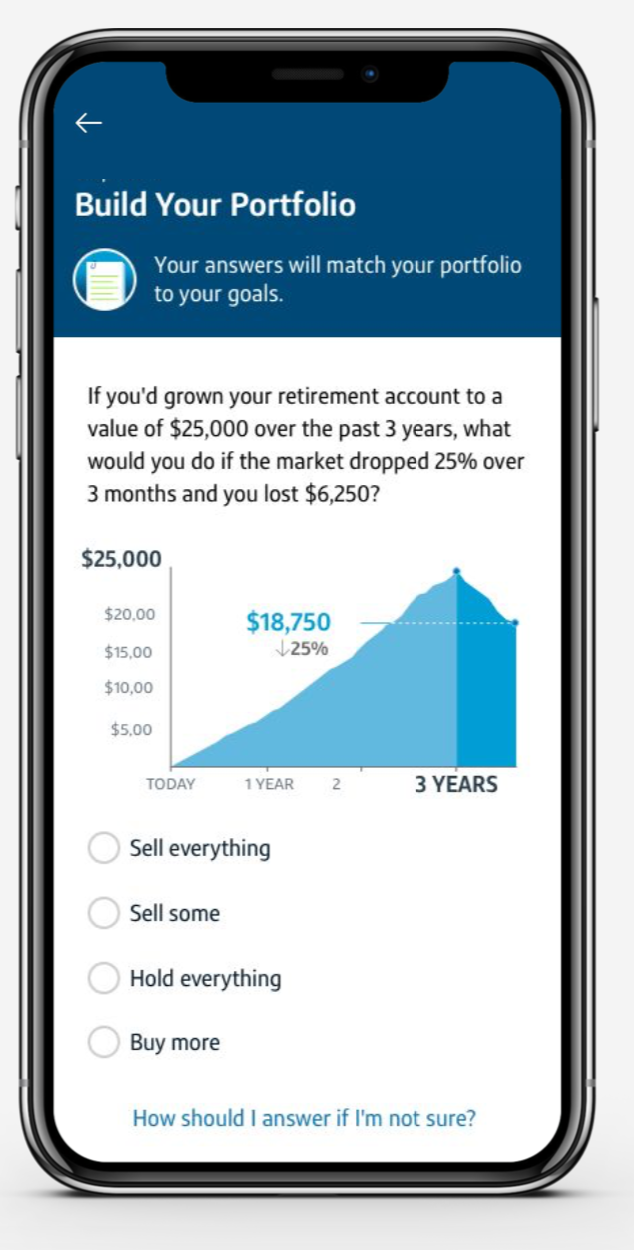

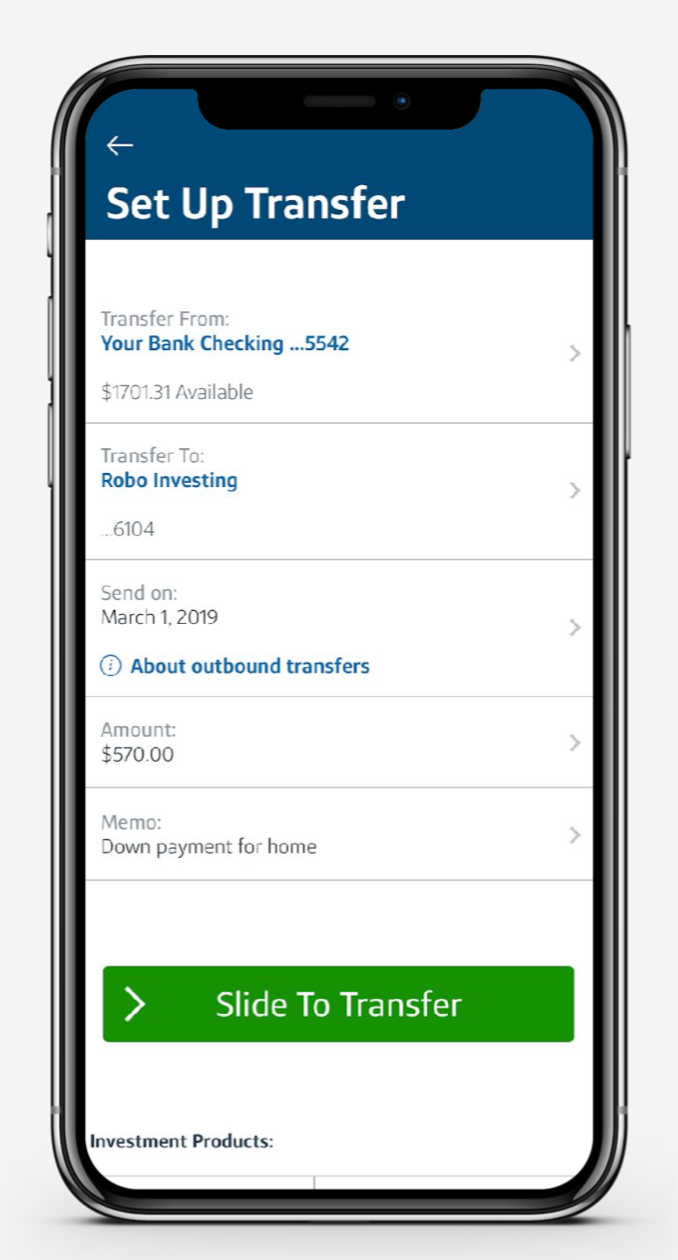

In this use case, our user can quickly set up an investing portfolio and account that meets specific risk tolerance, and financial needs. By utilizing the right modalities, we help the user accomplish the task within the context of their guidance.

Confirming Our assumptions

Our guidance depends on user’s current financial picture.

Part of giving good advice is confirming their numbers before they committing financially. Our users build several plans based on where they are at today.

Managing Trade-Offs and Plans

Tires blow, and monthly bills increase. We ensured that the user has full control to their existing plans to help them manage trade offs in the future.

Goals are often related, DGA provides the controls the user needs to make adjustments to single and grouped plans, even across different account types.

Launch Engagement Results

The Latest Launch went out to 180,000 customers.

Android

iOS

8.7% clicked on DGA Tile

6.9% committed to a Savings Plan

46% Transfer Confirmations

9.7% clicked on DGA Tile

8.3% committed to a Savings Plan

46% Transfer Confirmation